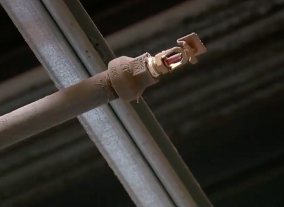

Huge tax incentives to install/retrofit fire sprinkler systems

Huge tax incentives to install/retrofit fire sprinkler systems

The National Fire Sprinkler Association praised sponsors and co-sponsors for their consistent leadership over the years that ensured fire sprinklers were included in the tax reform legislation passed by the House and Senate.

The Fire Sprinkler Incentive Act has been pushed for years. Fire protection has now been included and overall fire and life safety systems have joined other tax incentives, such as roofing, HVAC and security alarm systems.

"This accomplishment for fire and life safety has been 14 years in the making. To say we are excited is an understatement," explained Shane Ray, NFSA president. "Our NFSA team goal was to support Congressman Jim Langevin and all Congressional leaders over the years who sponsored and co-sponsored the bi-partisan legislation that was first filed following the tragic Station Nightclub fire in Rhode Island that claimed 100 lives in early 2003."

The NFSA team was led by long-time fire safety advocate Jim Dalton, who spent many days over the past 14 years meeting with legislators, their staffers, and fire service stakeholders who also championed this legislation. He was joined throughout this process by Vickie Pritchett, NFSA director of outreach and government relations.

"This provision in the tax reform bill will save lives," added Dalton, NFSA Senior Policy Advisor. "We are thankful for our partners from the Congressional Fire Services Institute, International Association of Fire Chiefs, International Association of Fire Fighters, National Fire Protection Association, National Fallen Firefighters Foundation, National Volunteer Fire Council, Common Voices, Security Industry Association, Phoenix Society for Burn Survivors, and others who championed this tax incentive."

The Tax Cuts and Jobs Act contained several critically important provisions that will provide significant incentives for property owners to install fire sprinklers. These include:

Small businesses will now be able to fully expense installation of fire sprinklers under section 179 of the tax code up to a cap of $1 million in each year of expense. This will allow for the retrofit and upgrading of numerous occupancies such as nightclubs. In addition, small businesses that may need to borrow money to pay for the retrofit will be able to fully deduct the interest expense on the loan.

Larger entities can fully expense capital expenses over the next five years. Starting in 2023, the amount that can be expensed will slowly taper down. This part of the provision means that fire chiefs and local policy officials can now ensure business owners have five years for full expensing, which we believe will provide the opportunity for many high-rise and other high-risk occupancy buildings to improve their fire safety features.

This article orginally appeared on the PHCPPROS website at https://www.phcppros.com/articles/6633-nfsa-applauds-fire-sprinkler-ince...